All Categories

Featured

Table of Contents

Life insurance policy supplies 5 economic advantages for you and your household. The major benefit of adding life insurance to your financial strategy is that if you die, your heirs obtain a round figure, tax-free payout from the plan. They can use this cash to pay your last expenses and to change your revenue.

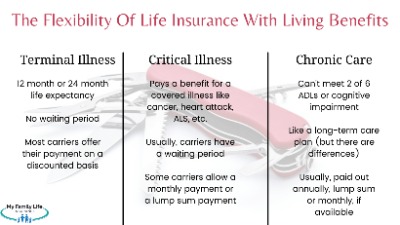

Some plans pay out if you create a chronic/terminal health problem and some offer savings you can utilize to sustain your retired life. In this article, learn more about the various advantages of life insurance policy and why it might be a good concept to buy it. Life insurance policy offers benefits while you're still to life and when you pass away.

Cash Value Plans

Life insurance coverage payouts typically are income-tax totally free. Some irreversible life insurance coverage policies develop cash worth, which is money you can obtain while still active. Life insurance policy could also pay if you develop a severe disease or go into an assisted living facility. The national median price of a funeral service that includes a funeral service and a burial was $7,848 as of 2021.

If you have a policy (or plans) of that dimension, the people that rely on your earnings will certainly still have money to cover their continuous living expenditures. Beneficiaries can make use of plan advantages to cover crucial everyday costs like rental fee or home mortgage payments, energy expenses, and grocery stores. Average annual expenses for homes in 2022 were $72,967, according to the Bureau of Labor Statistics.

Life insurance payments aren't taken into consideration earnings for tax obligation purposes, and your recipients don't have to report the money when they file their tax returns. Depending on your state's legislations, life insurance policy advantages may be used to balance out some or all of owed estate tax obligations.

Development is not influenced by market conditions, enabling the funds to gather at a secure rate over time. Additionally, the cash money worth of entire life insurance coverage expands tax-deferred. This indicates there are no earnings taxes built up on the money worth (or its growth) till it is withdrawn. As the money worth develops with time, you can use it to cover expenditures, such as acquiring a car or making a down payment on a home.

What is the best Trust Planning option?

If you choose to obtain against your money value, the lending is not subject to income tax as long as the policy is not given up. The insurance provider, however, will certainly charge interest on the loan quantity till you pay it back. Insurance coverage business have varying rate of interest on these fundings.

As an example, 8 out of 10 Millennials overstated the price of life insurance in a 2022 research. In reality, the typical price is better to $200 a year. If you assume spending in life insurance policy might be a wise economic action for you and your family members, think about consulting with a monetary advisor to embrace it right into your economic plan.

Policyholders

The 5 major kinds of life insurance are term life, whole life, global life, variable life, and last expense protection, additionally recognized as burial insurance. Entire life starts out setting you back a lot more, however can last your whole life if you keep paying the premiums.

It can repay your debts and medical bills. Life insurance policy can likewise cover your mortgage and give money for your household to maintain paying their costs. If you have family members depending on your income, you likely require life insurance coverage to support them after you pass away. Stay-at-home moms and dads and company owner also commonly need life insurance policy.

Lesser quantities are readily available in increments of $10,000. Under this plan, the elected protection takes effect two years after registration as long as premiums are paid during the two-year duration.

Insurance coverage can be prolonged for up to 2 years if the Servicemember is completely handicapped at splitting up. SGLI coverage is automatic for most energetic responsibility Servicemembers, Ready Get and National Guard participants set up to execute at the very least 12 durations of non-active training per year, participants of the Commissioned Corps of the National Oceanic and Atmospheric Administration and the Public Health and wellness Service, cadets and midshipmen of the United state

VMLI is available to Veterans who professionals that Got Adapted Particularly Adjusted Real EstateSAH), have title to the home, and have a mortgage on home loan home. All Servicemembers with permanent insurance coverage should utilize the SGLI Online Registration System (SOES) to assign recipients, or minimize, decrease or restore SGLI coverage.

All Servicemembers ought to utilize SOES to decrease, reduce, or bring back FSGLI protection.

Can I get Cash Value Plans online?

Plan advantages are lowered by any outstanding finance or car loan passion and/or withdrawals. If the policy gaps, or is given up, any impressive lendings thought about gain in the policy might be subject to regular revenue tax obligations.

If the policy proprietor is under 59, any kind of taxable withdrawal might additionally be subject to a 10% government tax obligation penalty. All whole life insurance plan warranties are subject to the prompt settlement of all called for costs and the insurance claims paying capability of the issuing insurance coverage firm.

The money abandonment value, funding value and fatality proceeds payable will be reduced by any lien impressive due to the repayment of a sped up benefit under this rider. The increased benefits in the very first year show deduction of a single $250 management charge, indexed at a rising cost of living price of 3% annually to the rate of acceleration.

A Waiver of Costs cyclist forgoes the responsibility for the policyholder to pay more premiums need to he or she end up being absolutely handicapped constantly for a minimum of six months. This motorcyclist will sustain an extra expense. See plan agreement for additional details and demands.

Who offers Mortgage Protection?

Discover more regarding when to obtain life insurance. A 10-year term life insurance policy plan from eFinancial expenses $2025 monthly for a healthy and balanced grownup who's 2040 years old. * Term life insurance is more budget friendly than irreversible life insurance policy, and women customers generally obtain a reduced rate than male customers of the exact same age and health and wellness status.

Latest Posts

Burial Insurance Policy Seniors

Burial Policy For Elderly

Cremation Insurance For Seniors