All Categories

Featured

If you're healthy and have never utilized cigarette, you'll generally pay more for home mortgage protection insurance than you would for term life insurance coverage (selling mortgage insurance). Unlike other kinds of insurance policy, it's tough to obtain a quote for mortgage defense insurance policy online - mortgage life protection plan. Costs for home mortgage defense insurance can vary commonly; there is much less openness in this market and there are a lot of variables to accurately contrast costs

Term life is a superb option for mortgage defense. Insurance policy holders can profit from a number of advantages: The quantity of insurance coverage isn't restricted to your home mortgage equilibrium.

You may want your life insurance policy policy to secure greater than just your home loan. You pick the plan value, so your coverage can be essentially than your home mortgage equilibrium. You could even have greater than one policy and "pile" them for personalized coverage. By piling plans, or bikers on your policy, you could decrease the life insurance advantage over time as your home loan equilibrium reduces so you're not spending for insurance coverage you do not require.

If you're guaranteed and pass away while your term life plan is still active, your selected loved one(s) can make use of the funds to pay the home mortgage or for one more function they pick. mortgage insurance in case of death. There are many benefits to making use of term life insurance coverage to shield your mortgage. Still, it may not be a best solution for everybody

Mortgage Protection Plan Worth It

Yes, due to the fact that life insurance coverage plans have a tendency to straighten with the specifics of a mortgage. If you purchase a 250,000 home with a 25-year home mortgage, it makes sense to purchase life insurance coverage that covers you for this much, for this lengthy.

Your family members or recipients get their lump amount and they can spend it as they like (term life insurance to pay off mortgage). It's vital to comprehend, however, that the Mortgage Protection payment sum decreases in accordance with your home loan term and equilibrium, whereas degree term life insurance policy will pay out the exact same lump amount any time during the policy length

Mortgage Liability Insurance

You might see that as you not getting your payment. However on the other hand, you'll be active so It's not like spending for Netflix. You don't see an obvious or in advance return of what you buy. The sum you spend on life insurance policy on a monthly basis doesn't pay back till you're no more below.

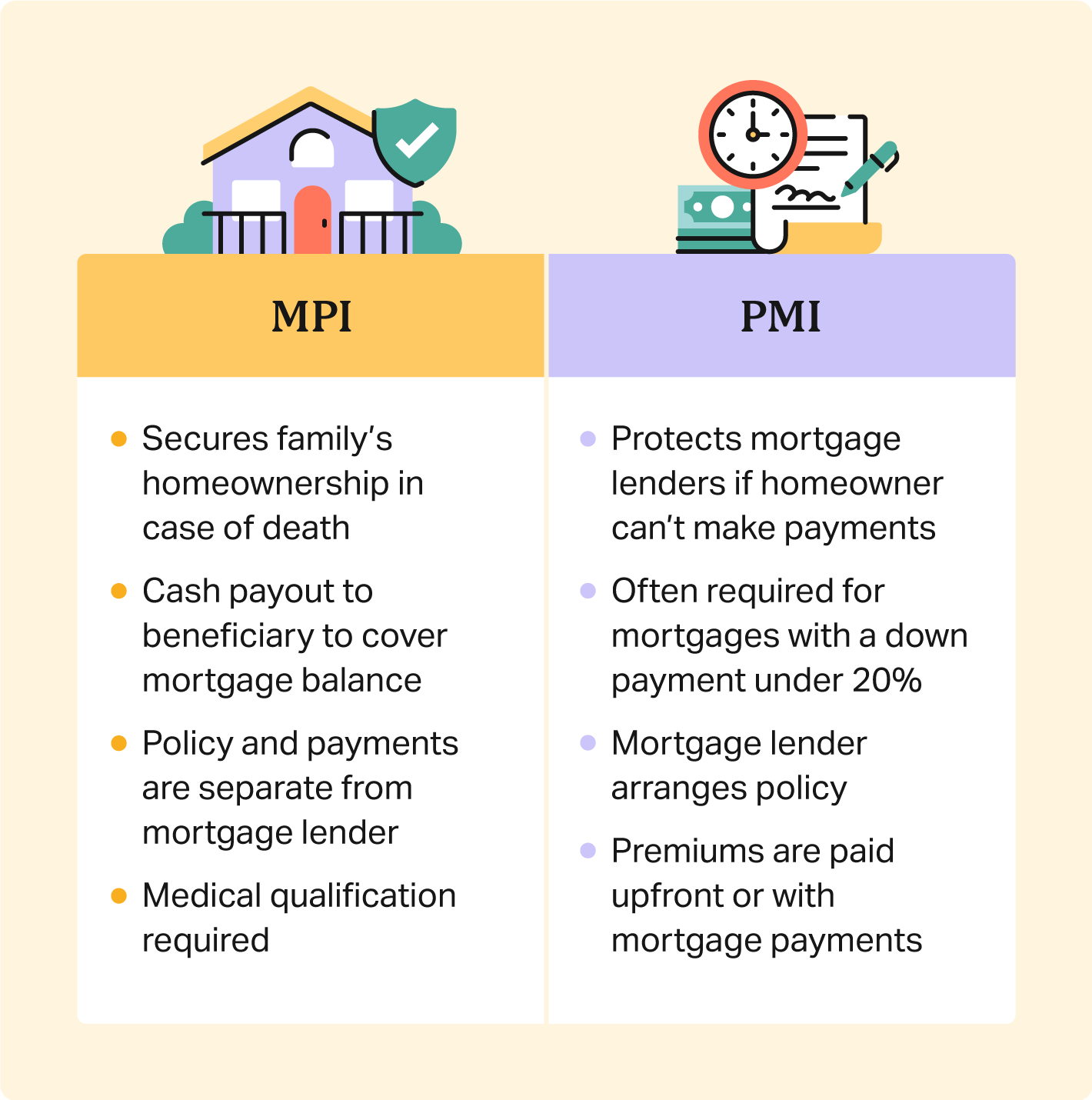

After you're gone, your liked ones do not have to fret concerning missing payments or being incapable to pay for living in their home (mortgage payoff insurance). There are two main selections of home loan defense insurance coverage, level term and decreasing term. It's constantly best to get advice to identify the plan that ideal speaks with your needs, budget plan and scenarios

Latest Posts

Burial Insurance Policy Seniors

Burial Policy For Elderly

Cremation Insurance For Seniors